Demystifying Domestic Content Requirements for Solar Projects

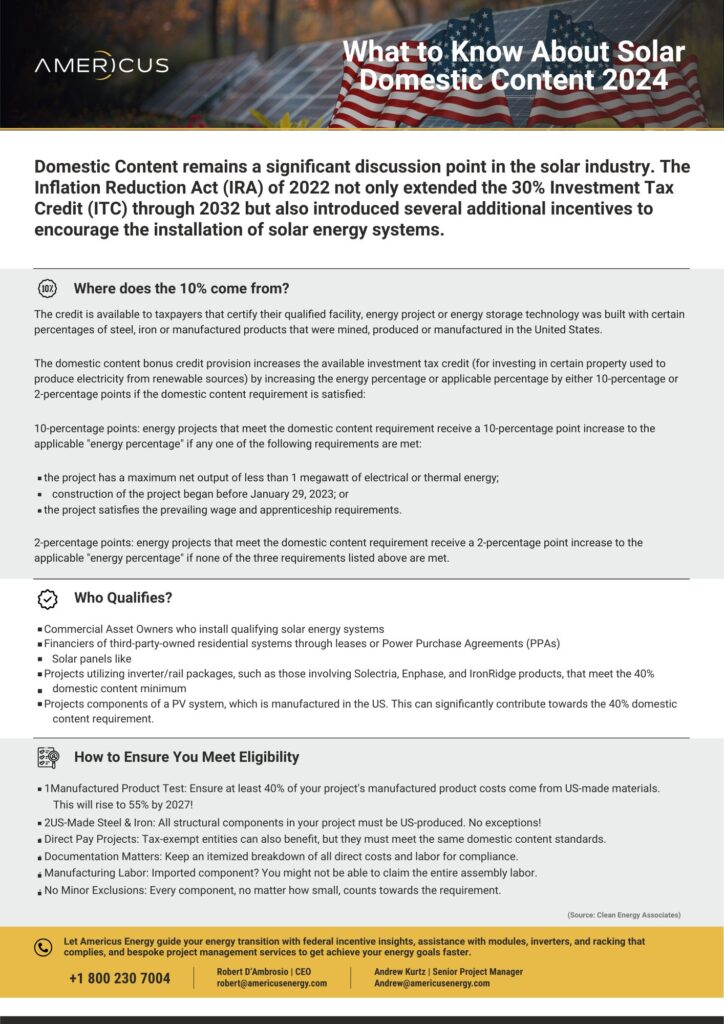

The IRS has recently introduced new guidelines that simplify the process for qualifying for a 10% bonus tax credit, which is important for companies in our industry. Let’s break down what this means for developers, investors, and the future of solar energy in America.

Understanding the New Elective Safe Harbor

Effective May 16, 2024, Notice 2024-41 has introduced an elective safe harbor that streamlines the calculation process for domestic content. This new provision is designed to make it easier for developers to meet the requirements and claim the bonus credit. The safe harbor allows the use of predetermined values to calculate the domestic content percentage, applicable to solar, onshore wind, and battery projects.

Key Requirements for Compliance

To qualify for the 10% bonus tax credit, solar projects must adhere to specific domestic content requirements:

- Steel and Iron: 100% of the steel and iron used in the project must be produced in the United States. This includes components such as steel photovoltaic module racking, pile or ground screw, and steel or iron rebar in the foundation.

- Manufactured Products: A certain percentage of the project’s manufactured products must be domestically produced. The required percentages are as follows:

- 40% for projects beginning construction before 2025

- 45% for projects beginning construction in 2025

- 50% for projects beginning construction in 2026

- 55% for projects beginning construction after 2026

Components of a Solar Project

For solar projects, key components include:

- Steel/Iron Products: Steel photovoltaic module racking, pile or ground screw, steel or iron rebar in the foundation.

- Manufactured Products: PV module, PV tracker, inverter.

- Components of a PV Module: Photovoltaic cells, mounting frame, glass, encapsulant, backsheet, junction box, etc.

Certification and Record-Keeping

Developers must certify compliance with these domestic content requirements to the IRS by:

- Attaching certification to tax returns for the year the project is placed in service.

- Including project details, location, and calculated bonus credit.

- Maintaining supporting records for potential IRS audits.

Why This Matters

This new guidance aims to simplify the process for taxpayers to qualify for the domestic content bonus credit, particularly for those using elective pay claiming entities. By making it easier to meet these requirements, the IRS is encouraging more developers to use domestically produced materials.

At Americus Energy, we are committed to leveraging these new guidelines to maximize the benefits for our projects and clients. We believe that these changes will not only streamline our operations but also contribute to the growth and sustainability of the solar industry in the United States.

We are here to help you navigate these new requirements and ensure that your projects qualify for the 10% bonus tax credit. If you have any questions or need further assistance, please do not hesitate to reach out to our team.

Contact Americus Energy:

+1 800 230 7004